First, let’s look at September 2023 statistics (end of FY 2023), then we will comment on the full FY stats.

As we reported here, September looked to be a slow month, and it was. While we missed a few full-approval actions (we reported forty-one), the OGD actually issued forty-four, and ten tentative-approval actions. Remember, the Agency was having trouble (and still is) with its IT system in posting these actions. With the official statistical report issued, we know that the total of fifty-four actions (full and tentative approvals) was the lowest total for any month in FY 2023.

A further look at the September ANDA approval numbers shows that, of the forty-four full-approval actions, ten (22.7%) were first-cycle approvals and six were first-time generic approvals. In addition, of the ten tentative approvals, two (20%) were first-cycle approvals.

The OGD issued 103 complete response letters (second lowest of the FY behind ninety-two that were issued in April), acknowledged sixty new ANDAs, and refused-to-receive only one ANDA in September. In other workload actions, the OGD approved 124 Prior Approval Supplements (more than the FY monthly average of 115) and issued 304 Information Requests and 257 Discipline Review Letters.

On the submission side of the house, I got a bit of a surprise—while the OGD received seventy-three new ANDAs in September, I was expecting a somewhat higher number of submissions as I thought there would be a mad rush for sponsors to get ANDA applications in before October 1st and the start of the new, significantly higher ANDA submission fee for FY 2024. The OGD also received 183 amendments, 979 supplements (846 of which were CBEs and 133 were for PASs), as well as 312 controlled correspondences (still lots of questions for the OGD from industry).

The rest of the monthly statistics as well as the totals for the full FY 2023, which we will discuss below, can be found here.

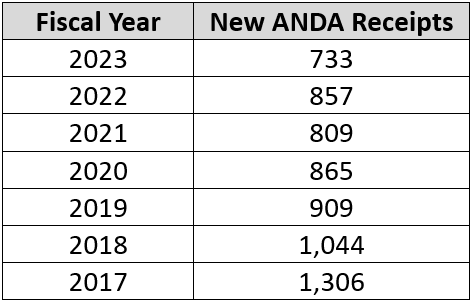

As we predicted, the OGD approved more applications than it received in FY 2023 (782 vs. 733); however, earlier in the year, we felt that the difference between approvals and receipts might be somewhat higher. But this is still a good sign as last FY the OGD issued 722 full approvals so the 782 for FY 2023 is encouraging. The number of new receipts for 2023 (733) is a bit disturbing, however, as can be seen in the table below, which presents submissions over the last seven fiscal years.

Hopefully, this trend will not continue as we need to ensure that the OGD has a steady stream of new work to keep them busy! Some of this slowdown in new ANDA submissions is likely related to consolidation in the industry, firms concentrating on more profitable complex generics, or moving their R&D dollars into biosimilars. We need to keep a close eye on the number of new ANDA submissions next year to see whether there is a rebound because another year with a drop like this could, perhaps, be a predictor of trouble for the generic industry in general and also potentially the OGD.

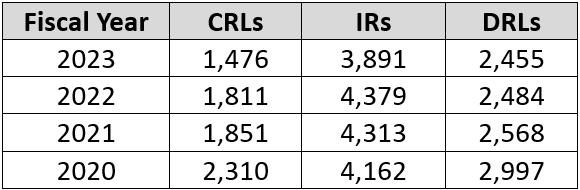

Here is another interesting table, which looks at the last five years of OGD issuance of CRLs, IRs, and DRLs:

The drop in the number of CRLs is likely attributable to the increased number of first-cycle approvals and the efficiency of IRs and DRLs to bring ANDAs to final approval within fewer cycles. As you can see, the number of mid-cycle review letters remained somewhat constant over the same time period.

The end of year total for ANDAs pending Agency Action (1,531) (a measure of the OGD’s workload) was the lowest of the year, and those pending applicant action (2,023) is the second lowest of FY 2023. This is also influenced by first-cycle approvals and lower original ANDA submissions, as well as withdrawals of pending ANDAs.

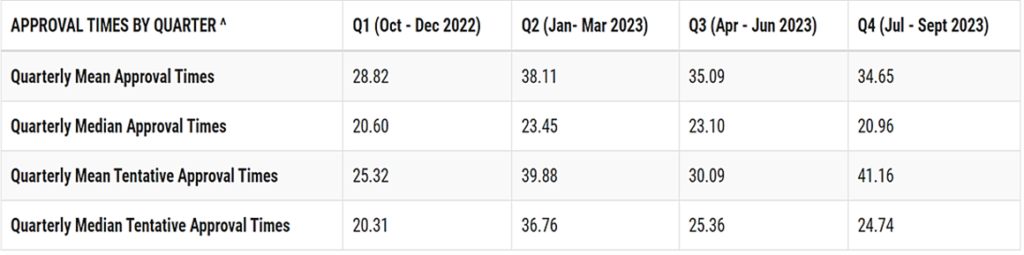

The final item I would like to address from the report deals with the fourth quarter mean and median approval times of ANDAs.

The table below (taken directly from the final FY 2023 OGD statistical report) shows that the median approval times are significantly lower than the mean approval times. The mean approval times are obviously more influenced by the cohort age of the applications. As the percentage of first-cycle approvals increases and some of the very old applications are either approved or withdrawn, the median and mean times to approval will be somewhat more convergent.

Now, as we prepare to await the first set of FY 2024 statistics, we will begin to see how the generic space will shake out. Will we continue to see lower submission rates, will ANDA approvals continue to outpace new ANDA submissions, and what impact with that have on the OGD, its staffing and responsiveness? What do you think? Email me at r.pollock@lachmanconsultants.com with your views!